In 2023, the Philippines was the 31st largest economy in the world in GDP size at purchasing power parity (PPP) values, and the 34th largest economy at current or nominal values. Our GDP size of $1.26 trillion was not far behind our neighbors: Malaysia with $1.28 trillion, Vietnam with $1.5 trillion, Thailand with $1.68 trillion, and Taiwan with $1.74 trillion.

The expansion of the Philippines’ and other East Asian economies was fast. From 2015 to 2023, Vietnam’s economy expanded by 102%, China’s by 98%, the Philippines’ by 77%, Singapore’s by 74%, Indonesia’s by 72%, and Malaysia’s by 70%. In contrast, G7 countries have expanded between Japan’s 28% to the US’ 52% (see Table 1).

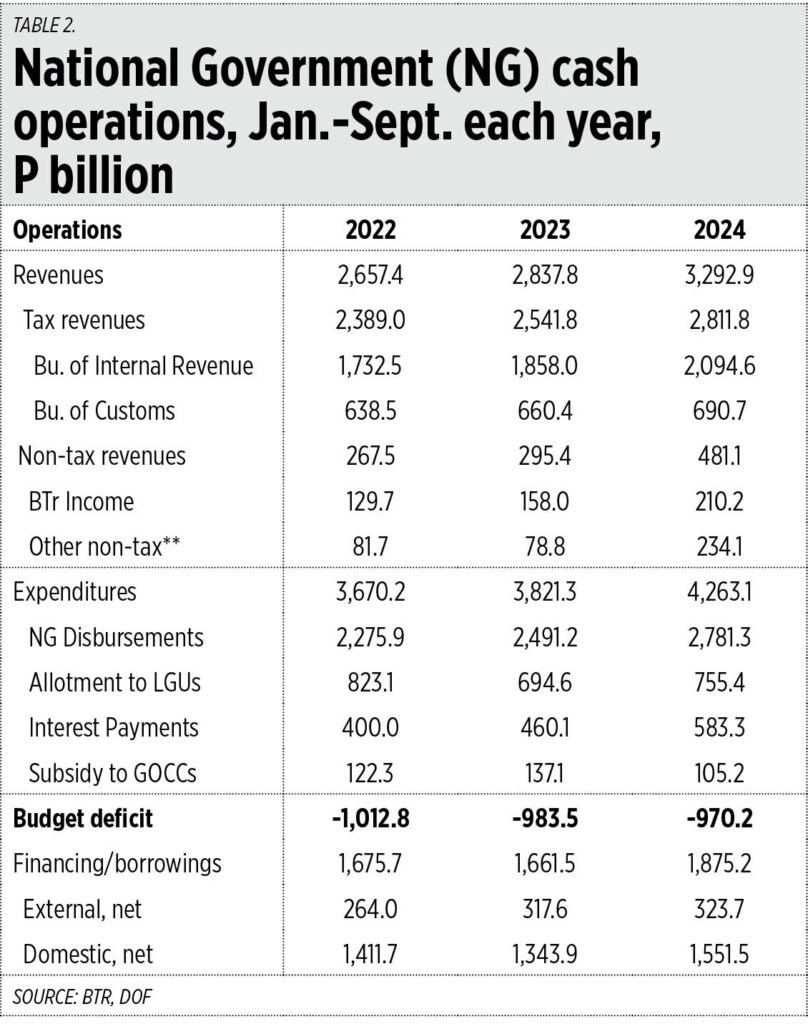

Last week the Bureau of the Treasury (BTr) released the government’s cash operations report for September. In my second table, I compared the January to September data on public finance over three years, 2022 to 2024.

The good news is that the budget deficit is declining, from P1 trillion in 2022 to P984 billion in 2023 and P970 billion in 2024.

There are two notable things in the report this year. One is the big expansion of “Other non-tax†revenues, from P82 billion in 2022, to P79 billion in 2023, and P234 billion in 2024. The other is the fast expansion of interest payment of our public debt, from P400 billion in 2022, to P460 billion in 2023 and P583 billion in 2024. If this trend continues, the full year 2024 interest payment may reach P875 billion (see Table 2).

That is a huge increase in interest payment — no thanks to the Bangko Sentral ng Pilipinas’ high interest rate policy, supposedly to control inflation, and the ever-rising expenditures of national agencies, including the military and uniformed personnel pension (which should be zero if only they would pay for their own pension) to around P164 billion a year.

The transfer to the National Treasury of P60 billion out of the P89.9 billion in idle funds of the Philippine Health Insurance Corp. (PhilHealth) has greatly contributed to the expansion of “Non-tax revenues.â€

TRO ON PHILHEALTH’S EXCESS

Last Tuesday, the Supreme Court issued a temporary restraining order (TRO) on the transfer of the remaining P29.9 billion (round this off to P30 billion). This means either P30 billion in unprogrammed expenditures in the national budget will not be implemented, or the Department of Finance (DoF) will borrow P30 billion at an interest rate of 6% (government bond 10-years) and pay P1.8 billion in interest alone plus principal amortization.

The petitioners and the Supreme Court wrote in largely legal arguments, which is not my field. But if they considered the economic arguments of the DoF and the economic team on why the P90 billion in excess PhilHealth funds — which come not from members’ contributions but from portions of the tobacco and alcohol tax and portions of the remittances from the Philippine Amusement and Gaming Corp., better known as PAGCOR, and the Philippine Charity Sweepstakes Office, meaning money from the pockets of gamblers, drinkers, and smokers — has been tapped to fund certain unprogrammed appropriations, they should have seen the logic and virtue of this move.

I hope that the TRO will be lifted soon, and the remaining P30 billion released so it can be used for certain programs and projects with unfunded appropriations.

Meanwhile, the beautiful musical I watched last year will be showing again — Silver Lining Redux, with music and lyrics written by my friend and fellow alumnus of UP School of Economics, Jack Teotico. It is a nostalgic musical, a retro trip down memory lane for the Baby Boomer generation, which tackles life in high school and UP circa the 1970s, and on to today’s issues of the Millennial and Gen Z generations. It will run from Nov. 8 to 10, then again from Nov. 15 to 17 at the Carlos P. Romulo Auditorium of the RCBC Plaza, Ayala Ave. corner Gil Puyat Ave., Makati City. Tickets are available at Ticket2me.net or through Dayana at 0917-174-6755.

Bienvenido S. Oplas, Jr. is the president of Bienvenido S. Oplas, Jr. Research Consultancy Services, and Minimal Government Thinkers. He is an international fellow of the Tholos Foundation.

minimalgovernment@gmail.com